Boise area real estate and rental management blog

When financing an investment property with five units or more, the investor looks to commeciail lenders. For those of you with rental properties with 4 units or less, such a fourplex or duplex, you will obtain a residential loan. Here is what is happening in the commercial lending world.

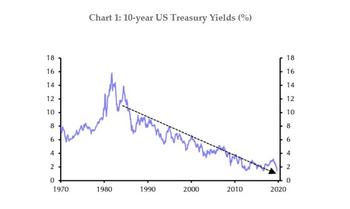

For the past 12 months, T Bond Yields have been at historic lows. How low you may ask…so low that T Bond Yields had never seen such low yields for the entire 230 year history of US T Bond yields.

In 1791 under Secretary Hamilton, the US assumed the Revolutionary War debt of the Colonies and confederation of States. To pay the debt the US issued Treasury bonds at a yield of 3%.

In the ensuing 230 years the T Bond Yield was never as low as we’ve seen in the past year.

The Good News: On Tuesday (2/16/21) the 10 Yr T Bond Yield was at 1.30%.

The Bad News: In August (8/4/20) we saw a historic low yield of 0.52%

Half Full - T Bond Yields are and have been in the lowest range ever seen by anyone currently alive.

Half Empty - Rates have more than doubled since the August low.

This begs the question: Will rates continue to trend upward as they have since August?

The Answer: Don’t believe anyone who proposes an answer.

The Black Swan is circling the US and world economies. Last year the Black Swan brought the Pandemic. This year the Black Swan is in flight but no one knows what unforeseen event is in the clutches of its claws.

Some think they see inflation in its claws. Inflation fears are rising, but the Fed wants inflation to rise. Fed Chairman Jerome Powell, Janet Yellen (Hamilton’s successor) have cautioned that inflation could accelerate for a time in coming months as the country opens up. But Powell and many private economists believe this will be only a temporary rise and not a sign that inflation is getting out of control.

Rush for the Exit: Last year many lenders moved wholly or partially to the Exit. They viewed current yields as too low to compensate for the risk of investing in real estate. That reaction was exacerbated by Pandemic influence on tenant capacity to pay rent.

Fortunately many lenders have dipped their toe back into the lending market.

Pick your Poison: Lenders have to make a choice: invest in a risky low yield stock market or invest in a risky low yield real estate market. Fortunately, real estate mortgage investment is again seen as a viable place for lenders to place money.

If you own a commercial property or an apartment complex that requires commercial financing, we always suggest speaking to Boise's own, Jack Harty, with Harty Mortgage Advisors. He's about as smart as they come. Jack's contact information is below.

Jack Harty

HARTY MORTGAGE ADVISORS

950 W. Bannock St - Ste 420

Boise ID 83702

Mobile: 208 863 0655

Email: jharty@harty.biz

Your Boise Investment Properties Team

Tony A Drost, Associate Broker, Swope Investment Properties

Stacy McBain, Associate Broker, Swope Investment Properties