Boise Residential Round-up

One of the hottest topics on people's minds right now (besides school for those with kiddos) is the Boise area real estate market. We all know that real estate is a huge driving factor in our economy. We also know that basic economics is all about supply and demand.

Last month, Boise Regional Realtor's released their mid-year housing summit information and the big takeaway is that we have a heightened demand paired with a decrease in supply. Year over year, buyer activity saw a drop in March, when the first COVID-19 case was reported, in Idaho which lead to a decrease in pending transactions.

By the end of May, however, buyer activity was well over levels from May of 2019 and continues to rise. Seller activity had been tracking along with 2019's numbers until they took a dive when Idaho's stay at home order came into effect. Unlike buyer activity, sellers have remained at much lower activity levels year over year showing a drop of 50.8% from June 2019 to June 2020. This inequality in trends have resulted in a heavy seller's market.

As opposed to a year ago, our current market is driven by a decrease in the supply of lower-priced existing homes, more new homes selling at higher prices and increased buyer purchasing power due to low mortgage rates, not from speculation.

Some of the factors affecting existing home supply include more individuals "aging in place" (possibly with COVID-19 concerns at a senior facility), homeowners delaying listing until they find their next home which is taking longer with limited inventory, and an overall increase in home prices. Other homeowners have decided to refinance to make payments more affordable or take out a home equity line of credit to remodel instead of moving. To compare times before the housing crisis to now, homeowners took out about $320 billion in equity in 2006 and in 2019 homeowners took out an estimated $80 billion.

The increase in demand is due to millennials entering the stage of wanting to own a home, growth in the economy, people moving here to retire, and in-migration from higher-priced metros due to our comparative affordability and their ability to work from home. Three years in a row, Idaho has been one of the fastest growing states and it's the expectation that we'll be among the top again in 2020. In a study that CoreLogic did, the average homeowner in the U.S. gained around $9,600 in equity during the past year through Q1 of 2020. Idaho had the highest year over year average with an increase of $24,400.

If you'd like more info about the market or have any questions about real estate in general, reach out to your trusted Swope Investment Properties agent! We're here to help!

(All info from this article is referenced from Boise Regional Realtors Ada County Housing Summit- July 24, 2020)

Paige Brown, Associate Broker, Swope Investment Properties

New Demand for Single Family Rental Homes

Investors have been purchasing single family homes as rentals as far back as I can remember. Today, multi-family homes’ low inventory and high price points in the Boise area are driving more investors to the sing family rental market. Some investors are cashing in on these higher prices by selling their multi-family in exchange for single family rental home.

"Cash flow is just as good, if not better with 1/4 the headaches,” said one local investor, who sold his Boise 4 plex and purchased several new single family homes in Meridian as rentals.

The single famiy rental market in Boise is so strong, some institutional investors reportedly plan on building subdivisions for the sole purpose of bringing newer inventory to the rental market and creating entire subdivisions to be occupied primarily by renters.

It doesn’t matter if the single family rental market is just being built or if it’s older, the due diligence is much like any investment property. Buyers should be adhering to their investment team's expert advice and recommendations. It is important to include your professional property manager during the due diligence for input on location and fair market rents. The single family rental home market is much more seasonal than multi-family. Property management experts say that once into September, single family vacancy and rental rates take a hit and don't start peaking back up again until the end of May. Your investment team should also utilize a residential investment real estate agent to guide you through the due diligence.

Please contact any of our agents who can show you real life single family rental performance and explain how the due diligence differs from your standard residential home purchase.

Contributors: Tony Drost, Associate Broker, Swope Investment Properties

Julie Tollifson, Least Team Leader, First Rate Property Management

Stacy McBain, Associate Broker, Swope Invesment Properties

July Ada County 4 Plex Values and Metrics

The multi-family investment property inventory continues to be very tight. There were only 2 four plexes sold in Ada County in July. Both were located on the Boise Bench and both appear to be presold. This shortage of investment properties is pushing prices but also pushing investors to other opportunities, such as single family homes.

Duble click the image to enlarge the graph.

Average 4 Plex Price: Year-to-date average sales price for four plexes within Ada County, which consists of Boise, Meridian, Kuna, and Star) is $610,000 or $152,500 per rental unit. The highest sales price has been for a new 4 plex located in Meridian, which is within a mile of the Meridian Village.

Price Per Square Foot: Investment properties are rarely valuated by a price per square foot. We track the data solely for trending purposes. Investment properties prices in Boise continue to increase, and its no surprise to see the price per square foot trending upward as well.

Gross Rent Multiplier: Is the ratio of the price of the real estate investment to its annual rental income before accounting for expenses such as property taxes, prooperty insurance, and utilities. For a prospective real estate investor, a lower GRM may represents a better opportunity.

The GRM is useful for comparing and selecting investment properties where depreciation effects, periodic costs (such as real estate taxes and prooperty insurance) and costs to the investor incurred by a potential renter (such as utilities and repairs) can be expected to be uniform across the properties (either as uniform values or uniform fractions of the gross rental income) or insignificant in comparison to gross rental income. As these costs are also often more difficult to predict than market rental return, the GRM serves as an alternative to a measure of net investment return where such a measure would be difficult to determine.

The current trailing 6-month average GRM is 155. Example: $620,000 Sale Price / $4,000 Gross monthly rental income = 155.

Today, it is quite common for GRM to be quoted by real estate professionals using annual rents rather than monthly rents. A 155 GRM (monthly rents) = 12.91 GRM (annual rents).

The common measure of rental real estate value based on net return rather than gross rental income is the capitalization rate. In contrast to the Gross Rent Multiplier, the cap rate is not a multiplier but a rate of annual return.

Capitalization Rate: The trailing 6-month average for cap rate is currently 4.9%. The capitalization rate (also known as cap rate) is used in real estate to indicate the rate of return that is expected to be generated on a real estate investment property. This measure is computed based on the net income which the property is expected to generate and is calculated by dividing net operating income by property asset value and is expressed as a percentage. It is used to estimate the investor's potential return on their investment in the real estate market.

While the cap rate can be useful for quickly comparing the relative value of similar real estate investments in the market, it should not be used as the sole indicator of an investment’s strength because it does not take into account leverage, the time value of money and future cash flows from property improvements, among other factors. There are no clear ranges for a good or bad cap rate, and they largely depend on the context of the property and the market.

We will continue to follow and measure the Boise investment property market. Feel free to contact us with any questions.

COVID Affects Boise Vacancy and Rents

As reported by Julie Tolifson, RMP with First Rate Property Management, Boise, ID

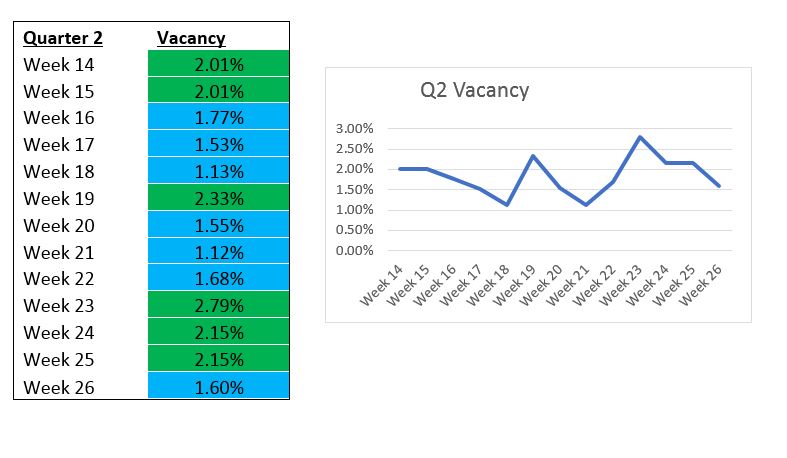

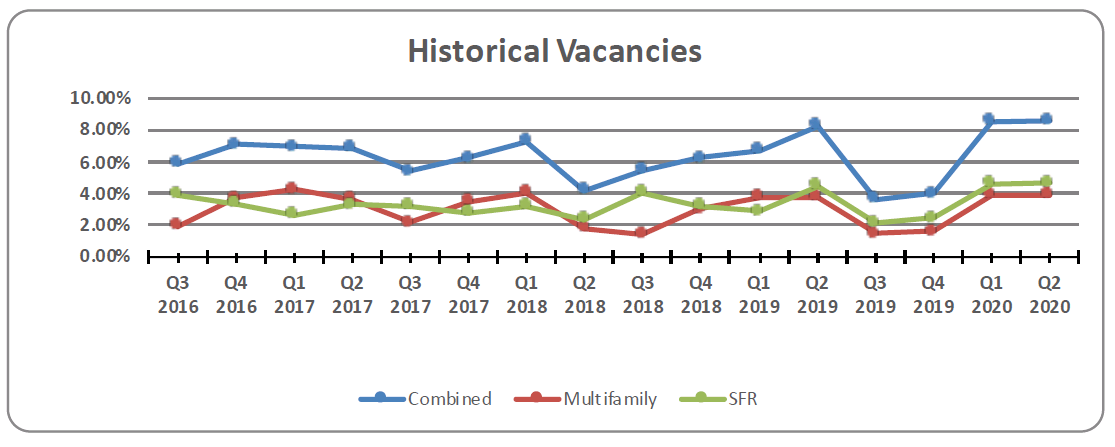

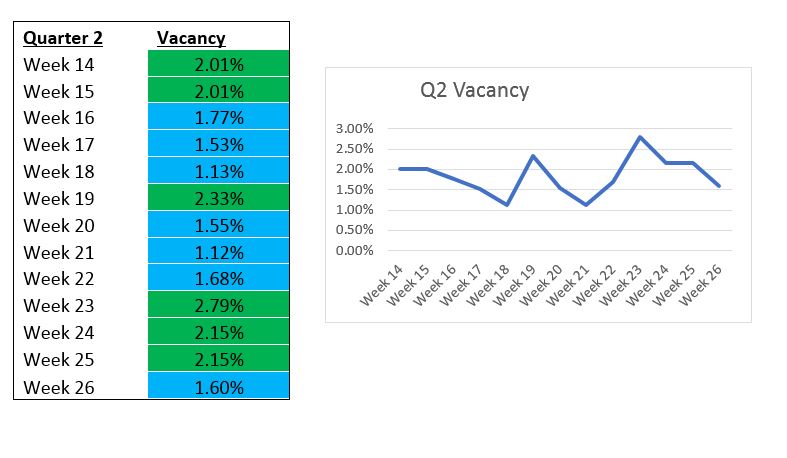

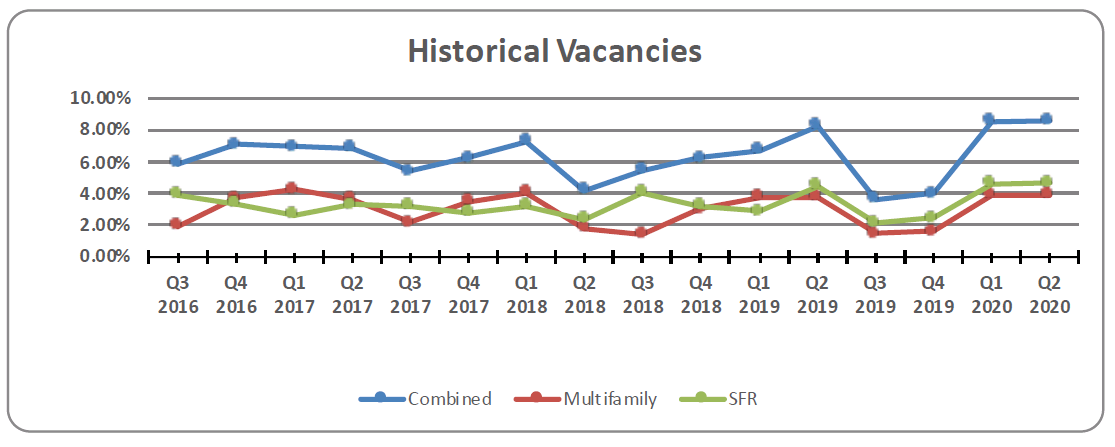

The National Association for Residential Property Management; SW Idaho Chapter to have a 4.14% Vacancy for Q2 of 2020. The industry has been stagnant since Q1. Similar to last quarter, landlords are wanting to be proactive and anticipate a potentially higher vacancy. In order to combat this challenge, many landlords are minimizing increases or, in some cases, not even increasing at all. For this reason we are not expecting drastic changes in the seasonality of our vacancy, however, we do expect to see a lesser increase in average rental rates.

Last quarter, we predicted the affects of COVID-19 on the rental market. We anticipated vacancies to trend upward as a result of social distancing and stay-at-home-orders. While the trend did not increase, it also did not decrease.

First Rate Property Managements vacancy rate for the past 12 weeks has been at an average of 1.83%. In our last report we indicated that First Rate Property Management recommends being less aggressive on renewal rates. This has proven to be successful in Q2. While the market has not taken the dip that we all anticipated in March, we are also seeing more people renewing their lease than usual. This has resulted in a well-balanced turnover to renewal ratio.

In Q3 we anticipate the market to slow down in accordance with the usual property management seasonal trends. While we continue to try and navigate this unprecedented circumstances, we will continue to find a balance in renewal rates until the treasure valley market starts to acclimate to a new normal.